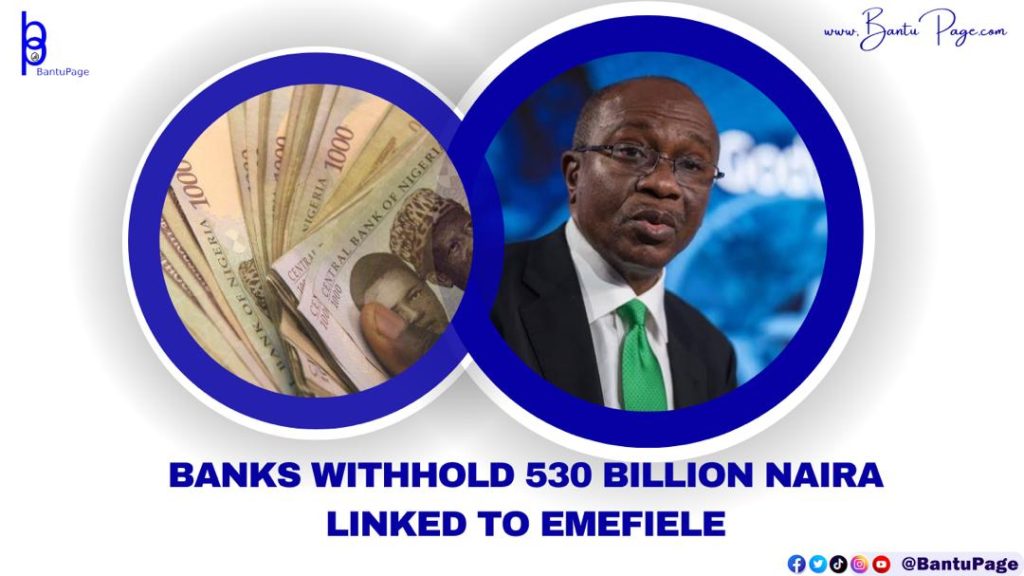

Banks withhold 530 billion naira linked to Emefiele

Recent findings indicate that around N531.4 billion of the intervention funds from the Central Bank of Nigeria are still sitting unused in the accounts of nine banks in the country. This was disclosed after the current governor, Olayemi Cardoso, suspended all CBN intervention funds.

In October of last year, when Governor Cardoso took office, he made the decision to pause all development finance interventions.

This was done to prioritise the CBN’s core mandate.

The distinction between monetary policy and fiscal intervention had become unclear, leading to a move away from direct development finance interventions.

Instead, the CBN now has a more limited advisory role to support economic growth.

Godwin Emefiele, the former governor, spearheaded the previous CBN administration and was responsible for implementing numerous intervention programmes.

Some of the initiatives implemented are the Anchor Borrowers Programme, the 100-for-100 Policy on Production and Productivity, the Nigerian Electricity Market Stabilisation Facility, the N1 trillion Real Sector Facility, the Agribusiness/Small and Medium Enterprise Investment Scheme, and the Micro, Small, and Medium Enterprise Development Fund, among others.

Reports indicate a significant disbursement of N9.71 trillion for development finance interventions during that period.

Despite the discontinuation of these programmes, there are still nine banks that hold over N530 billion in unused intervention funds.

Here’s a detailed breakdown of the amounts held by each bank:

Zenith Bank reported a total of N157.81 billion.

Fidelity Bank recorded a total of N98.85 billion.

Access Bank reported a total of N94.63 billion.

Sterling Bank’s $80.34 billionGTB recorded a total of N52.39 billion.

The United Bank of Africa (UBA) reported a total of N20.87 billion.

FCMB recorded a total of N13.17 billion.

Stanbic IBTC Bank reported a total of N11.49 billion.

Wema Bank reported a total of N1.83 billion.

Originally intended for distribution to beneficiaries, these funds remain unallocated.

The situation prompts inquiries about effective utilisation and responsibility within the banking sector.

Governor Cardoso might contemplate the possibility of requesting a refund or reallocating these funds towards initiatives that can make a greater impact.

By Nnaemeka Odenigbo